Phone Par Loan Kaise le 2023 mei ?

Friends in this todays’ article I will tell you that how will you get loan from Phone par loan app . This loan app can provide you instant personal loan with very less time. Make sure you must follow all the guidelines from this loan app. This loan app is very popular among the users as it provides loan very easily.

The user if is in need of instant personal loan then this loan app may be very helpful to you. The loan app is mostly used by salaried person as it provides advance salary loan to the users. The name of this app is Phone par loan app. The loan app is widely used among the people all over the country. Lets talk about this phone par loan app briefly in detail:

Read This :-Kosh loan app | Kosh loan app review | New loan application

What is Phone par Loan app?

Lets talk about this phone par loan app. This loan app is very popular as it has crossed over 10 lakhs plus downloads on the google play store. This app has a good rating of 3.1 on the google play store. The loan app is very popular as it provides zero fee collateral loan to the applicants. In this post we will know how to apply for loan in phone par loan app but there are certain things that one must know before applying the loan which are discussed below:

Phone par Loan amount:

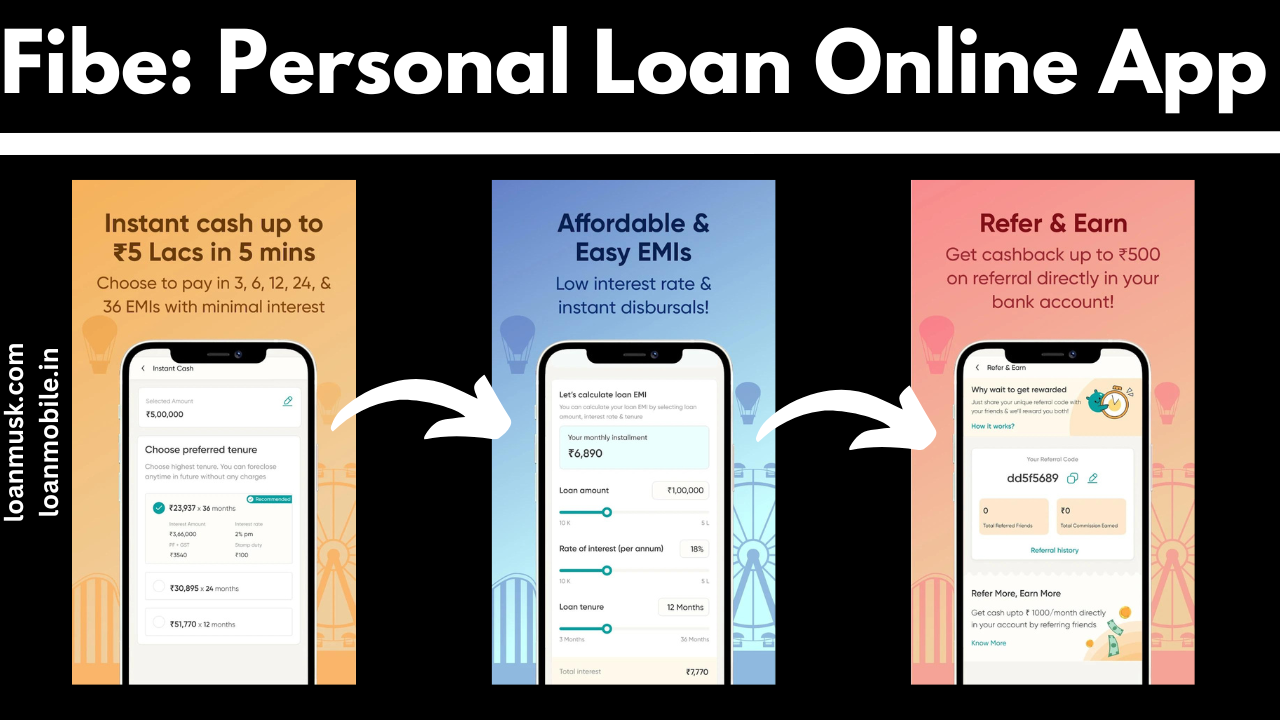

The applicant applies for the loan in any loan app before knowing that what is the maximum and the minimum amount of loan that the loan app provide to the users. The phone par loan app provides very good amount of loan . The range of the loa amount of this phone par instant personal loan app vary from rs. 10,000 to 5 lakh. If you are in a hurry and want a loan amount from 10k to 5L then this app may be helpful to you.

Phone par loan apply process(phone par loan kaise le)

So coming to the main thing that everyone asks for is the loan applying process. You need not to worry because the whole process to apply for the loan in this app is online . Anyone can apply for the loan in this app from any where In the country. The phone has very simple interface which allows the user to apply for the loan in very less time . the steps to apply for the loan in Phone par loan app are:

Read This :-Cash india instant personal loan app review | Cash india instant loan apply process

- Firstly download the Phone par instant personal loan app from google play store.

- Now register yourself with your phone number and make a new profile of your own.

- Now Chose the type of loan which you want.

- You can also chose any loan offer if available.

- You can now fill all the personal details.

- Now upload all the KYC documents and selfie.

- Now fill all the bank details.

- After this chose the loan amount and apply for the loan.

- If you are eligible then you will be sent a message regarding the loan approval.

- After the loan approval the loan amount is directed to your bank account.

So this was the whole process to apply for the loan if you want to know more then make sure to subscribe our channel loan hub and do check out our latest posts.

Phone par Loan Interest rate:

Lets talk about the main factor which is very important for any loan app. This Loan app has a quite good Interest rate. The interest rate of this loan app as low as is 1.25 to 3.5% per month. This ca also vary depending upon the profile of the user and the loan amount the person has taken.

Read This :-Cash india instant personal loan app review | Cash india instant loan apply process

Therefore if you want to take loan at this interest rate then this phone par loan app is good to go.

Phone Par Loan Processing fee:

This is one of the other important thing that one must keep in mind before applying for any kind of loan from any app. This is the processing fee. It is also known as the upfront fee. The processing fee of phone par loan app is also quite good. It varies from 2 to 8%.

Types of Loans:

Let me tell you there are several types of loan that this phone par loan app provides to the users. If you are here for personal loan then it is also available but there are many several loans which can help you. Lets take a look over to these types:

- Personal loans

- Travel loans

- Vehicle loans

- Wedding loans

- Repayment loans

- Medical loans

- Renovation loans

So these were some of the main types of loans that this phone par loan app provides to the customers PAN India.

Read This :-How to take loan from Tata Capital Loan App | TATA loan app

Phone par Loan App documents Required:

This loan app is very easy to use and has a very good interface but before applying the loan in this app you must need to know that what are the documents that one must require to apply for the loan in This Phone par loan app:

- The Person must have valid ID proof like Aadhar card and PAN card.

- The Identity proof like passport, driving license, voter id can also be used.

- All The KYC documents, selfie and signature is required.

- The bank account statement of at least 6 months is required .

Phone Par Loan Eligibility criteria:

Lets talk about the eligibility criteria that one must assure before one can apply for any type of loan in this app. The eligibility criteria is as follows:

Read This :-Credit Card Online Apply Process | Credit Card full details

- The person must be a citizen of india.

- The person must have at least age of 18 years or above.

- If your age is less than 18 then you are not able to apply for loan in this app.

- The person must have valid ID proofs.

Phone Par loan app Tenure rate:

Lets talk about the tenure rate that one must know about. The person also applies for the loan when he get to know that the tenure rate of any loan by the loan app is flexible. The tenure rate of Phone par loan app varies from 6 months to 5 years which is quite amazing. So if you are also here to apply for the loan within this during then this app can be proven helpful to you.

Read This :-Avail Finance Customer care Number | Avail Finance loan App